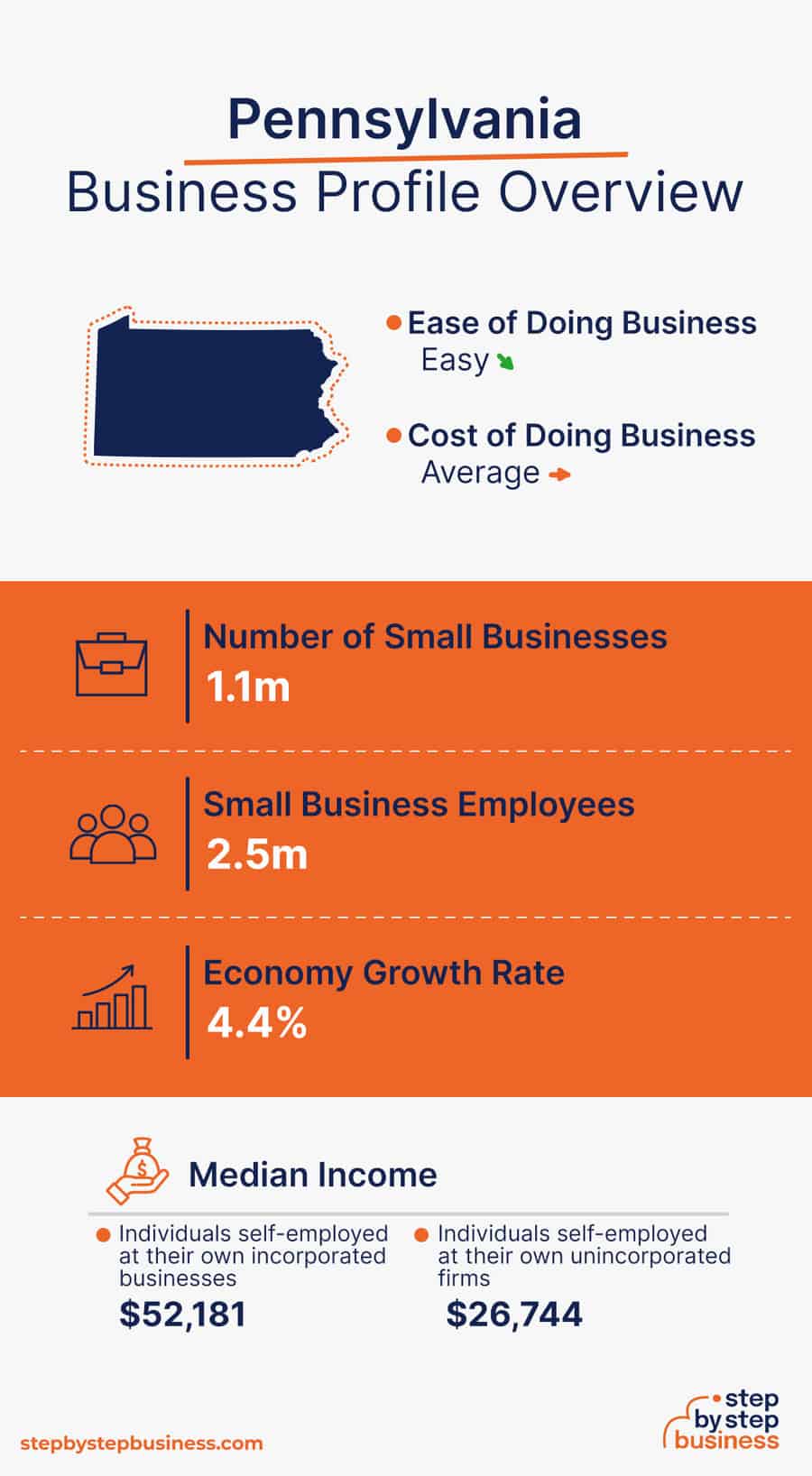

Pennsylvania is home to the US chocolate capital and the Declaration of Independence. It also has a history of innovation — home to the first computer and the first piano — and boasts the country’s most diverse and 6th-largest economy. Financial advisor WalletHub ranks Pennsylvania 2nd among all 50 states in terms of quality of life.((https://wallethub.com/edu/best-states-to-live-in/62617))

If you’re thinking of starting a business in Pennsylvania, opportunity abounds because of the diversity of industries. Starting any business, however, takes work, time, and patience. You should be prepared with information before you jump in. Following the steps outlined in this guide will put you on your way to launching a successful business in Pennsylvania.

Pennsylvania Business Profile Overview

Biggest Industries in Pennsylvania

By 2022 revenue((https://www.ibisworld.com/united-states/economic-profiles/pennsylvania/))

- Health & Medical Insurance -$93.2b

- Hospitals – $61.2b

- Colleges & Universities – $57.7b

- Drug, Cosmetic & Toiletry Wholesaling – $57.6b

- Life Insurance & Annuities – $49.9b

1. Choose a Business Idea to Start in Pennsylvania

The crucial first question is, what sort of business would you like to run? You may have several ideas in your head, or maybe you haven’t gotten that far. Either way, it’s wise to look closely at the state itself and at your own abilities to best determine which areas might offer the most opportunity.

To develop a business idea, you could:

- Look for market gaps or problems that need solving. Maybe your neighborhood lacks a good cafe, or the state’s farm industry needs modernization.

- Follow your passion. What do you love? What are you great at?

- Look at what’s trending in Pennsylvania and which industries are key to its economy. Big sectors include broadcasting, telecoms, healthcare, and construction. Food products and publishing are also growing fast.

Once you have a few ideas in mind, do some homework to decide if your ideas are feasible. Here are some things to consider when choosing a business idea:

- Capital requirements – How much will you need? Do you have access to funds?

- Time requirements – How long will it take for you to start selling?

- Industry trends – Is the industry growing or shrinking?

- Profit potential – How much money can you realistically make?

- Lifestyle factors – Running a business is hard work. Are you ready?

2. Hone Your Idea

Once you have chosen a business idea, get more specific in your evaluation of the opportunity. Consider the why, what, how, and who.

Why? Identify an Opportunity

Before anything else, consider the viability of the business idea you have in mind. Here are three questions to consider:

- Is there an opportunity in the market?

- Will your idea provide value to customers?

- Will people want to buy it?

Starting a business will require investment, so you mustn’t just leave the profitability of your idea to assumptions. Make it a point to conduct your own research and ask people you know and trust what they think of your idea.

What? Determine Your Products or Services

The next thing to do is define your offerings. Ask yourself:

- Which products or services will I sell?

- How will I offer them: website, physical store/office, or both?

You may consider offering related products or services to increase purchase sizes and boost overall value for customers. This step is going to define what your business will look like to customers and why they will buy, so take your time and be sure.

How Much Should You Charge?

Before determining your price list, get to know your competitors. Visit the shops and websites of companies that offer the same or similar products or services — see what they’re selling and at what prices and use this to inform your decisions.

If you have a direct competitor, it’s a good idea to choose a competitive price point. Run the numbers to determine your break-even price, then decide your profit-generating mark-up from there.

You’ll also need to consider how to position your product. Are you going to offer a lower-priced alternative, a la Walmart, or are you going to position your business as more high-end, like a Pottery Barn or Restoration Hardware?

Once you’ve locked on a pricing system that works for you, you’ll need to test it to see if this is attractive to your target market.

Who? Identify Your Target Market

Knowing your target market is crucial to successful sales and marketing. This is where customer profiling comes in handy.

The first thing to do is figure out whether you’re selling to consumers or businesses. If you choose consumers, determine which people are most likely to buy, by looking at:

- Demographics – Age, gender, income, location

- Psychographics – Attitudes, values, interests, tastes

Knowing your customers will allow you to shape your messaging and know where to place your marketing. For example, based on who your customers are and what they like, are they more likely to be on Facebook or TikTok?

If you are selling to businesses, first determine what kinds of firms will be interested in what you’re offering. Next, figure out the relevant decision-maker within these companies — it may be a VP, IT manager, or head of sales — and adjust your marketing accordingly.

3. Choose a Business Name

Your business name is your business identity, so choose one that encapsulates your objectives, services, and mission in just a few words. You probably want a name that’s short and easy to remember.

Here are some ideas for brainstorming your business name:

- Short, unique, and catchy names tend to stand out

- Names that are easy to say and spell tend to do better

- The name should be relevant to your product or service offerings

- Ask around — family, friends, colleagues, social media — for suggestions

- Including keywords in the name, such as “meats” for a butcher, boosts SEO

- Choose a name that allows for expansion: “Jim’s Bakery” over “Jim’s Cookies”

- Avoid location-based names that might hinder future expansion

- Use online tools like the Step by Step business name generator

Once you have a few potential names, check the Pennsylvania state website to confirm they are available to register. You should also confirm that the name you want to register conforms to Pennsylvania state regulations on business names.

It’s also a good idea to check for nationally trademarked names, to ward off any potential problems later if your business expands, and check the availability of related domain names using Domain Name Checker tool. Using “.com” or “.org” sharply increases credibility, so it’s best to focus on these.

Once you’ve found a name that clears these hurdles, go ahead and register at this Name Reservation Request form for the state of Pennsylvania.

4. Create a Business Plan

Drawing up a business plan may seem like a daunting task, but it’s an essential step in creating a successful business. The plan will function as a trail map to guide your startup through the launch process and maintain focus on your key goals. A business plan also enables potential partners and investors to better understand your company and its vision.

- Executive Summary: Brief overview of the entire business plan; should be written after the plan is complete.

- Business Overview: Overview of the company, vision, mission, ownership, and corporate goals.

- Product and Services: Describe your shop’s services in detail.

- Market Analysis: Assess market trends such as variations in demand and prospects for growth, and do a SWOT analysis.

- Competitive Analysis: Analyze main competitors, assessing their strengths and weaknesses, and create a list of the advantages of your services.

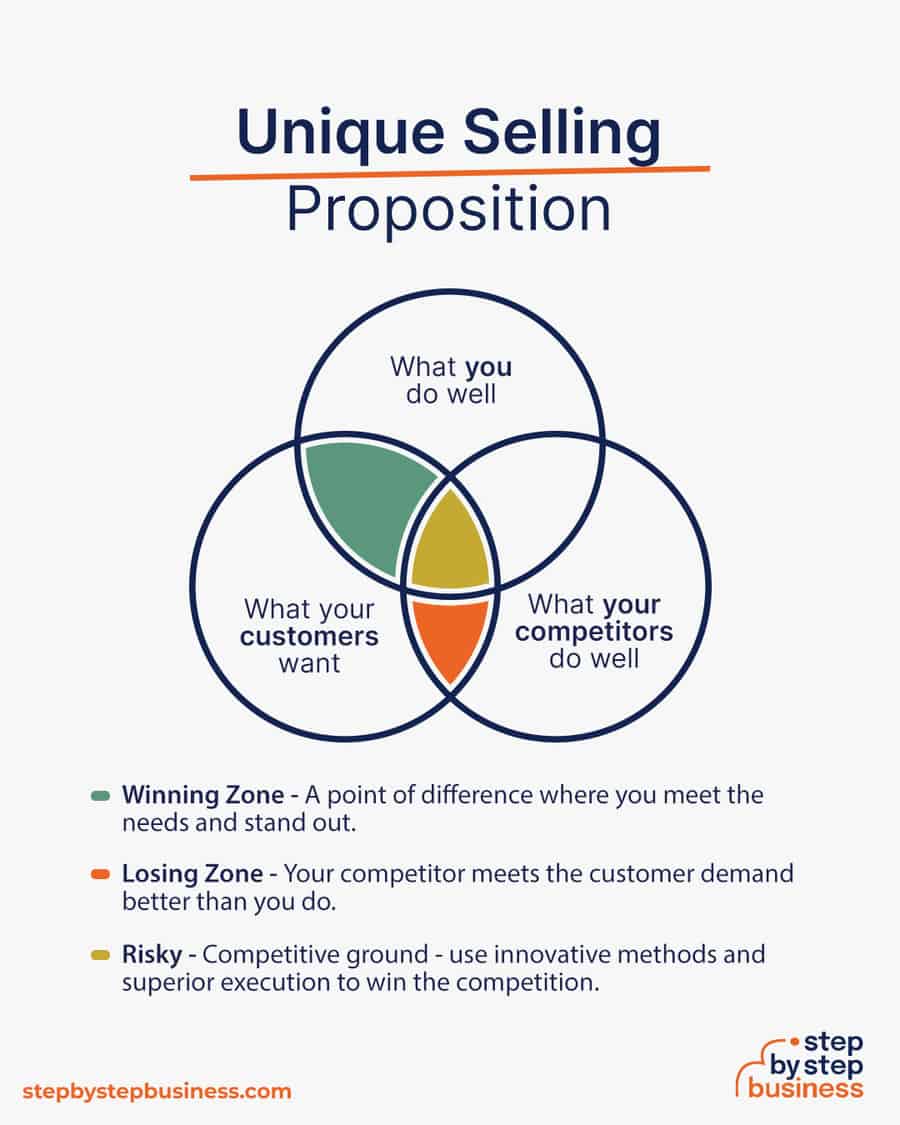

- Sales and Marketing: Examine your companies’ unique selling propositions (USPs) and develop sales, marketing, and promotional strategies.

- Management Team: Overview of the management team, detailing their roles and professional background, along with a corporate hierarchy.

- Operations Plan: Your company’s operational plan includes procurement, office location, key assets and equipment, and other logistical details.

- Financial Plan: Three years of financial planning, including startup costs, break-even analysis, profit and loss estimates, cash flow, and balance sheet.

- Appendix: Include any additional financial or business-related documents.

If you’ve never created a business plan yourself before, it can be an intimidating task. Consider hiring an experienced business plan writer to create a professional business plan for you.

5. Register Your Business with the Pennsylvania Department of State

Choosing your business location is an important decision because it can affect your taxes, legal requirements, and revenue. But you’ve already decided to launch your business in Pennsylvania, so we can check that box.

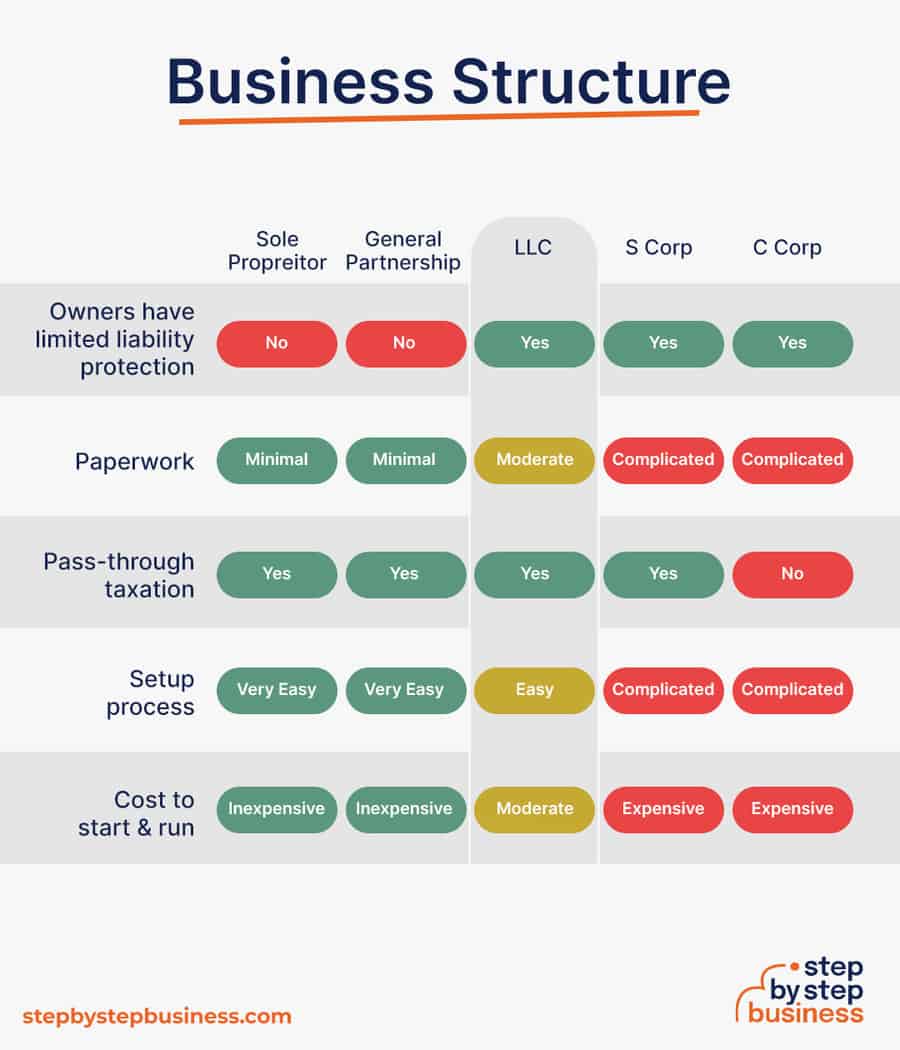

Choose your business structure

Businesses come in several varieties, each with its pros and cons. The legal structure you choose for your business shapes your taxes, personal liability, and business registration requirements, so it’s important to choose wisely.

The most popular business entity types are outlined below.

Sole Proprietorship

Sole proprietorship is the most simple and straightforward structure, and therefore the most common for small businesses. It is an unincorporated business, with no legal distinction made between the business and the owner. This means that as a sole proprietor you get to keep all the profits, but are also personally liable for any debts, losses, or liabilities.

General Partnership

A general partnership is similar to sole proprietorship, but in this case two or more people form the company. Again, they keep the profits but are jointly liable for any losses or liabilities. In a general partnership, each partner is known as a general partner and has unlimited liability.

Limited Liability Partnership (LLP)

This business structure is popular with lawyers, accountants, and architects. It is more formal than a general partnership and allows each partner to limit their liabilities and share management responsibilities according to an agreement between the partners. This can be a good choice when one or more partners want to invest in the business but have little or no management responsibility.

There is a $125 fee to register your LLP in Pennsylvania.

Corporation

The next step up is a corporation, in which the company is a separate legal entity from its owners. In this structure, the owners are not personally liable for losses, but take their profits through shareholder dividends.

If you choose to create a Pennsylvania corporation, you will also need to decide whether you want to form a C corporation or an S corporation. Here are some resources:

There is a $125 filing fee to file your Articles of Incorporation with the Pennsylvania Secretary of State.

Limited Liability Company (LLC)

A limited liability company (LLC) combines characteristics of corporations with those of sole proprietorships. As the name suggests, the owners are not personally responsible for liabilities or debts.

Although LLCs are more straightforward to set up than a corporation, Certificate of Organization must be filed with the state for the LLC to become a legal entity.

There is a $125 filing fee to file your Certificate of Organization with the Pennsylvania Secretary of State.

You will also need to appoint a Pennsylvania registered agent. Your registered agent will be responsible for receiving paperwork from the state.

An easy and quick way to form an LLC in Pennsylvania is to use ZenBusiness’s online LLC formation service.

Nonprofit

Finally, you may be interested in a nonprofit if your business idea has a social purpose. A non-profit organization is a legal entity organized and operated for a public or social benefit, as opposed to a business formed to generate a profit for its owners.

You will also need to appoint a registered agent, also known as an agent for the service of the process. Your Pennsylvania registered agent will be responsible for receiving all of the official paperwork sent from the state.

There is a fee of $125 for filing Articles of Incorporation for a nonprofit in Pennsylvania.

6. Register for Taxes

The final step before you’re able to pay taxes is getting a Pennsylvania Employer Identification Number or EIN. You can file for your EIN online or by mail or fax: visit the IRS website to learn more. Keep in mind, if you’ve chosen to be a sole proprietorship you can simply use your social security number as your EIN.

Once you have your EIN, you’ll need to choose your tax year. Financially speaking, your business operations will occur over the period of a calendar year (January–December) or a fiscal year, a 12-month period that can start in any month. This will determine your tax cycle, while your business structure will determine which taxes you’ll pay.

It is important to consult an accountant or other professional to help you with your taxes to ensure you are completing them correctly.

In Pennsylvania, all businesses are required to register with the Pennsylvania Department of Revenue. You can also check out this guide to Pennsylvania taxes for all you need to know about state taxes.

7. Fund Your Business

After creating your business plan, you should know how much money you’ll need to launch your business. Securing financing is your next step and there are plenty of ways to raise capital:

- Bank loans: This is the most common method, but getting approved requires a rock-solid business plan and strong credit history.

- SBA-guaranteed loans: The Small Business Administration can act as guarantor, helping gain that elusive bank approval via an SBA-guaranteed loan.

- Government grants: A handful of financial assistance programs help fund entrepreneurs. Visit Grants.gov to learn which might work for you.

- Venture capital: Offer potential investors an ownership stake in exchange for funds, keeping in mind that you would be sacrificing some control over your business.

- Crowdfunding: Websites like Kickstarter and Indiegogo offer an increasingly popular low-risk option, in which donors fund your vision. Entrepreneurial crowdfunding sites like Fundable and WeFunder enable multiple investors to fund your business.

- Personal: Self-fund your business via your savings, the sale of property or other assets, and support from family and friends.

8. Apply for Pennsylvania Business Licenses/Permits

You may need to obtain certain business licenses and permits to comply with Pennsylvania law. These permits and licenses can vary based on the town or city where the business is located. Here are some resources:

Your city, town, or county may also have additional requirements, such as signage and zoning permits. Speak to representatives of your local governments about licensing requirements.

This is not a step to be taken lightly, as failing to comply with legal requirements can result in hefty penalties.

If you feel overwhelmed by this step or don’t know how to begin, it might be a good idea to hire a professional to help you check all the legal boxes.

For peace of mind and to save time, we recommend using MyCorporation’s Business License Compliance Package. They will research the exact forms you need for your business and state, and provide them to you to make sure you’re fully compliant.

9. Open a Business Bank Account

In order to launch your business, you will need to have somewhere to keep the money you make, and that requires opening a bank account.

Keeping your business finances separate from your personal account makes it easy to file taxes and track your company’s income, so it’s worth doing even if you run your business as a sole proprietorship. Opening a business bank account is quite simple, and similar to opening a personal one. Most major banks offer business account options, just inquire at your preferred bank to learn about rates and features.

Banks vary in terms of offerings, so it’s a good idea to consider your options to choose the best plan that works for you. Once you choose your bank, you’ll need to bring your EIN (or Social Security Number if you decide on a sole proprietorship), articles of incorporation, and any other legal documentation that proves your business is registered.

10. Get Insurance

Business insurance is an area that often gets overlooked yet is vital to your success as an entrepreneur. Insurance protects you from unexpected events that can have a devastating impact on your business.

Here are some of the different types of insurance to consider:

- General liability: The most comprehensive type of insurance, acting as a catch-all for many business elements that require coverage. If you get just one kind of insurance, this is it. It even protects against bodily injury and property damage.

- Business Property: Provides coverage for your equipment and supplies.

- Equipment Breakdown Insurance: Covers the cost of replacing or repairing equipment that has broken due to mechanical issues.

- Worker’s compensation: Provides compensation to employees injured on the job.

- Property: Covers your physical space, whether it is a cart, storefront, or office.

- Commercial auto: Protection for your company-owned vehicle.

- Professional liability: Protects against claims from a client who says they suffered a loss due to an error or omission in your work.

- Business owner’s policy (BOP): This is an insurance plan that acts as an all-in-one insurance policy, a combination of any of the above insurance types.

11. Prepare to Launch

As opening day nears, prepare for launch by reviewing and improving some key elements of your business.

Essential software and tools

New businesses need to have the right tools and industry-specific software in place to help them manage their operations effectively.

One of the most important tools for a new business is an inventory management system, which allows them to track their inventory levels, monitor sales, and reorder products when necessary.

Another essential tool is a customer relationship management (CRM) system, which helps businesses manage their interactions with customers and prospects, and track sales leads.

Other useful software for new businesses might include payroll software, project management tools, and marketing automation software. By investing in the right tools and software, new businesses can streamline their operations, save time and money, and ultimately increase their chances of success.

Accounting

- Popular web-based accounting programs for smaller businesses include Quickbooks, Freshbooks, and Xero.

- If you are unfamiliar with basic accounting, you may want to hire a professional, especially as you begin. The consequences for filing incorrect tax documents can be harsh, so accuracy is crucial.

Develop your website

Website development is crucial because your site is your online presence and needs to convince prospective clients of your expertise and professionalism.

You can create your own website using services like WordPress, Wix, or Squarespace. This route is very affordable, but figuring out how to build a website can be time-consuming. If you lack tech-savvy, you can hire a web designer or developer to create a custom website for your business.

They are unlikely to find your website, however, unless you follow Search Engine Optimization (SEO) practices. These are steps that help pages rank higher in the results of top search engines like Google.

Online Marketing

Online marketing is crucial for new businesses as it provides a cost-effective way to reach a wider audience and build brand awareness. With a well-planned online marketing strategy, new businesses can establish their presence, attract potential customers, and compete with established players in their industry.

Here are some powerful digital marketing strategies for small businesses:

- Social media is a great tool for promoting your business because you can create engaging posts that advertise your products:

- Facebook: Great platform for paid advertising, allows you to target specific demographics, like men under age 50 in the Philadelphia area.

- Instagram: Same benefits as Facebook but with different target audiences. It’s a very good platform for creative businesses.

- TikTok: This social media platform has over 1 billion monthly active users and it is used primarily by a younger demographic.

- LinkedIn: the most effective place for B2B marketers.

- Google and Yelp: For businesses that rely on local clientele, getting listed on Yelp and Google My Business can be crucial to generating awareness and customers.

- Email marketing/newsletter – Send regular emails to customers and prospects. Make them personal.

- Start a blog – Start a blog and post regularly. Change up your content and share on multiple sites.

- Paid ads on social media – Choose sites that will reach your target market and do targeted ads.

- Pay–per-click marketing – Use Google AdWords to perform better in searches. Research your keywords first.

- Influencer marketing – Pay people with large social media followings to promote your product/service. You can find micro-influencers with smaller followings and lower rates.

- Make a podcast – This allows you to make a personal connection with your customers.

- Offer a free download – Offer something of value to download from your website to capture emails.

- Create infographics – Post infographics and include them in your content.

- Post a video – Post a video about your product/service. Use humor and maybe it will go viral!

- Do a webinar – Share your expertise online with a video seminar.

Take advantage of your website, social media presence and real-life activities to increase awareness of your offerings and build your brand.

Traditional Marketing

Traditional marketing is any form of marketing that uses offline media to reach an audience. Some options include:

- Competitions and giveaways – Generate interest by offering prizes for customers who complete a certain action.

- Signage – Put up eye-catching signage at your store and website.

- Flyering – Distribute flyers in your neighborhood and at industry events.

- In-Person Sales – Offer your product at local markets, trade shows.

- Cold calling – Close more sales with less stress.

- Sponsor events – You can pay to be a sponsor at events that are relevant to your target market.

- Limited edition – Offer a one-time version of your product of service.

- Seek out referrals – Offer incentives to generate customer referrals to new clients.

- Press releases – Do press releases about new products, sales, etc.

- Billboards – Repeat exposure to a business message.

- Testimonials – Share customer testimonials about how your product or service has helped them.

12. Build Your Team

As your business grows, you will likely need workers to fill various roles and positions. But before you begin the hiring process, you should first consider the essential positions for your line of work.

What levels of management and employees will you have? What is your pay scale? Costs are always an issue for a startup, but you need to make sure that you pay enough to hire people with the right skills and experience.

It’s a good idea to create a hiring plan. First, determine which hires you’ll need to launch, then the future hires you’ll need as the business gets going. Be cautious and selective when hiring people for any role.

You want to build a great team that will make your business run smoothly and create a great work environment so you’ll retain them for a long time.

In Pennsylvania, you need to report new hires to the state’s New Hire reporting site.

Free-of-charge methods to recruit employees include publishing a job ad on LinkedIn or Facebook or using free classified sites like Jobs and AngelList. You might also use a premium recruitment option, such as advertising on Indeed, Glassdoor, or ZipRecruiter. Finally, you could hire a recruitment agency to help you find talent.

13. Start Making Money

With everything in place, you’re now ready to throw open the doors on opening day! When you do, you’ll want some customers coming in. Here’s how to find them.

Focus on Your USPs

Make sure to highlight the unique selling propositions, or USPs, of your products and services. Customers may already want your offerings, so your job is to convince them to pick you over your competitors.

Here are some good selling points that you can capitalize on:

- High-quality materials

- Top value items, competitively priced

- Easy to use

- Convenient and time-saving

- Ideal for your target market

Understand Your Sales Channels

Make sure that you are selling through the right channels. You know your target customers by now – where and how are they most likely to buy? Do they buy online or in stores?

If you don’t have a store, you can find partner stores where your products can be sold. You can sell both online and directly but focus your efforts on the channel that matches your target market’s buying behavior.

If you’re selling to businesses, your sales channels may be online or they may involve direct sales calls. Again, understand the buying behavior of the decision-maker within the business.

Grow with Marketing

Help clients find you more easily by placing your marketing where they are likely to find it. With the right marketing strategies in place, a business can reach new audiences, build brand awareness, and ultimately grow its customer base and revenue.

Effective marketing can help businesses differentiate themselves from competitors, establish a strong online presence, and engage with customers through various channels such as social media, email marketing, and advertising.

By investing in the right marketing tactics and continually analyzing and optimizing their efforts, businesses can position themselves for long-term growth and success.

FAQs

How much does it cost to register a small business in Pennsylvania?

The fee to register any type of business entity in Pennsylvania is $125. Corporations and non-profits must also file an annual report for a fee of $70. LLCs do not have to file an annual report in Pennsylvania.

Is Pennsylvania a good state to start a business? Many opportunities exist for businesses in Pennsylvania. Taxes are higher than in most other states, but the economy is large and diverse. Financial advisor WalletHub ranked PA among the 10 best states to live and 2nd overall in terms of quality of life.

What’s the best kind of business to start in Pennsylvania?

Opportunities in Pennsylvania may be found in larger industries such as broadcasting and telecommunications, or growing industries like publishing. You do not have to limit yourself, however, to those industries. Because the economy in Pennsylvania is so diverse, you can start almost any type of business. Follow your passion!

Do I need a business license to sell goods in Pennsylvania?

At the state level, you only need a sales tax license unless your type of business requires other licenses. You may, however, need local licenses depending on where you are. Check with your local governments.

Comments